Salary and tax calculator

That means you pay taxes on it at your regular income tax rate between 10-37. This software is for the employees of Uttar Pradesh in the financial year Designed to.

Pin On Ux Ui

All Services Backed by Tax Guarantee.

. Ad Payroll So Easy You Can Set It Up Run It Yourself. Get Your Quote Today with SurePayroll. SARS Income Tax Calculator for 2023.

This is an offline tool which is built in MS Excel. Find The Perfect Payroll HR Software For Your Business Needs. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

11 income tax and related need-to-knows. Check your tax code - you may be owed 1000s. Salary Income Tax Gross Salary Tax Rate.

Salary Income Tax Slabs 2022 - 2023. Your household income location filing status and number of personal. Our income tax calculator calculates your federal state and local taxes based on several key inputs.

Calculate how tax changes will affect your pocket. As you enter or change your details youll see how this affects your allowances how much of your income is taxed and the amount of tax and long-term care. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail.

Use our employees tax calculator to work out how much PAYE and UIF tax you will pay SARS this year along with your taxable income and tax rates. This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. Get Started Today with 1 Month Free.

Plug in the amount of money youd like to take home. As per Federal Budget 2022-2023 presented by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2022. Your average tax rate is.

Try out the take-home calculator choose the 202223 tax year and see how it affects. That means that your net pay will be 40568 per year or 3381 per month. The Salary Calculator has been updated with the latest tax rates which take effect from April 2022.

Its so easy to. Enter up to six different hourly rates to estimate after-tax wages for hourly employees. As a general rule the IRS classifies rental income as passive income and taxes it accordingly.

Just select your province enter your gross salary choose at what frequency youre being paid yearly monthly or weekly and then press calculate. Step 2 Check the results. See where that hard-earned money goes - with Federal Income Tax Social Security and other.

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11432. Transfer unused allowance to your spouse. The Indian Tax Calculator calculates tax and salary deductions with detailed tax calculations and explanations based on the latest Indian tax rates for 20222023 assessment year.

As per the Federal Budget 2022-2023 presented by the Government of Pakistan the following slabs and income tax rates will be applicable for. If you make 55000 a year living in the region of New York USA you will be taxed 11959. The Tax Caculator Philipines 2022 is.

Ad Take the hassle out of paying your employees by Letting the Software Handle the Payments. Your average tax rate is. The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

How to use the Income Tax Calculator. Free tax code calculator. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

Sage Income Tax Calculator. Here are the formulas on how to calculate personal employee income tax pension gross and net income in Ethiopia. Youll then see an estimate of.

Our online tax calculator is in line with changes announced in the 20222023 Budget Speech. Whatever Your Investing Goals Are We Have the Tools to Get You Started. That means that your net pay will be 43041 per year or 3587 per month.

The calculation is based on Nepal Government Tax Policy. Salary tax calculator is designed for calculating tax payable to Nepal government on the salary earned in a given year.

Pin On Raj Excel

Salary Calculator Salary Calculator Calculator Design Salary

Pin En Canada

Earnings Before Interest Tax Depreciation And Amortization Ebitda Defination Example Financial Statement Analysis Financial Statement Income Statement

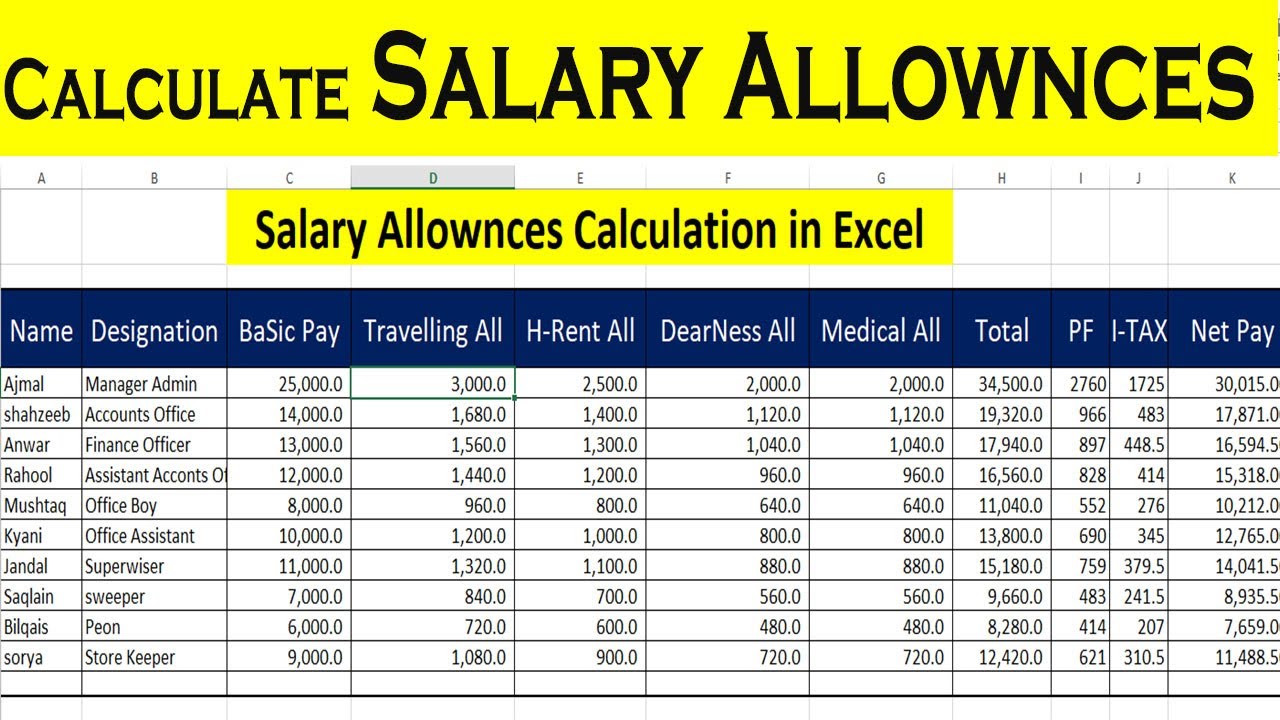

Calculate Salary Allowances And Tax Deduction In Excel By Learning Cente Excel Learning Centers Tax Deductions

Access Database For Small Business Payroll Software And Tax Templates Access Database Payroll Software Payroll

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Paycheck Pay Calculator

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Tax Calculator Calculator Design Financial Problems Calculator

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Pay Calculator Salary

Income Tax Calculator App Concept Calculator App Tax App App

Self Employed Tax Calculator Business Tax Self Employment Employment

What Is Annual Income How To Calculate Your Salary Income Income Tax Return Salary Calculator

Pay Scale What Is Pay Scale How To Calculate Pay Scale Paying Scale Consumer Price Index

Tax Calculator Excel Spreadsheet Excel Spreadsheets Spreadsheet Excel

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator